Welcome to The Flywheel, where we take a deep look at a company’s business and products to understand which areas are spinning smoothly and where a little grease may be needed. Learn more about The Flywheel here.

If you’re reading this but are not subscribed, consider joining us to receive every new Flywheel article (1-2 times per month) directly in your inbox!

I started writing The Flywheel because the flywheel is a great framework for understanding a company (and because I like drawing on my iPad). What I didn't fully appreciate at first is just how well the Flywheel puts into context the winners and losers following macro events. During COVID-19, the mother of all macro events, the company flywheels I've dissected (Peloton and Zoom) explain what was already in motion that allowed these companies to capitalize on the shifts brought on by the pandemic. Today we're sticking with that theme. In this article we go deep on Robinhood, the stock trading app to which millennials have flocked in the millions to try to capitalize on market turbulence.

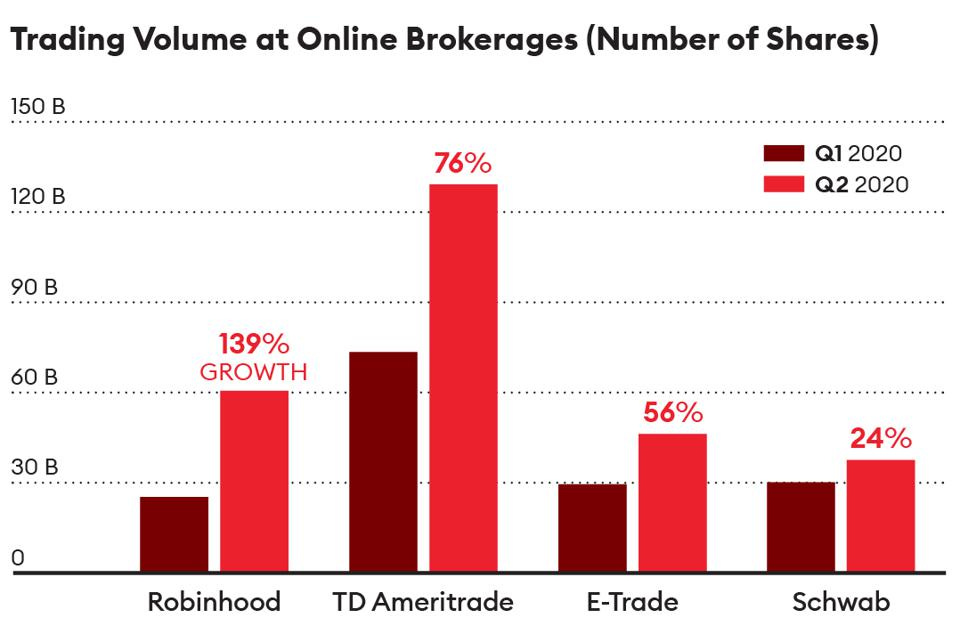

Robinhood is interesting right now for several reasons. First, the stock market's crash and subsequent recovery has been a major piece of the COVID story overall. As market volatility increased, so did trading volumes, and nowhere was this more true than in Robinhood's platform. Young people in particular have flocked to Robinhood to get a piece of the action (I admit I am one of them), and it has become a part of the zeitgeist in 2020.

[Source]

Second, the company struck while the iron was hot, raising over half a billion VC dollars in two quick-fire rounds this summer. The company has long promised to pursue an IPO, and with the slew of big tech IPOs hitting the market, pundits have speculated that Robinhood could be on deck.

Lastly, I wanted to write about Robinhood because it's an ethically ambiguous, complex topic, which makes it fun (and difficult) to explore. Depending on how you choose to look at it, Robinhood is either a force for good in the world, democratizing investing and finance for the little guy, or the shark with the biggest teeth in the already infested waters of the investing industry.

What is Robinhood

Robinhood is a stock, options, and cryptocurrency trading app that launched in 2013. As company lore has it, the cofounders were inspired by Occupy Wall Street to build a company that would democratize investing and stop ripping off the little guy. At a time when stock trades at other discount brokers like Schwab and E*Trade cost $5 or $10 per trade, Robinhood pioneered the concept of commission-free trades. It wouldn't be until 2019 that its largest competitors followed suit, but they eventually did, and today free trading is commonplace for individual investors.

Robinhood's Business Model

If trading is free, how does Robinhood make money?

[Source]

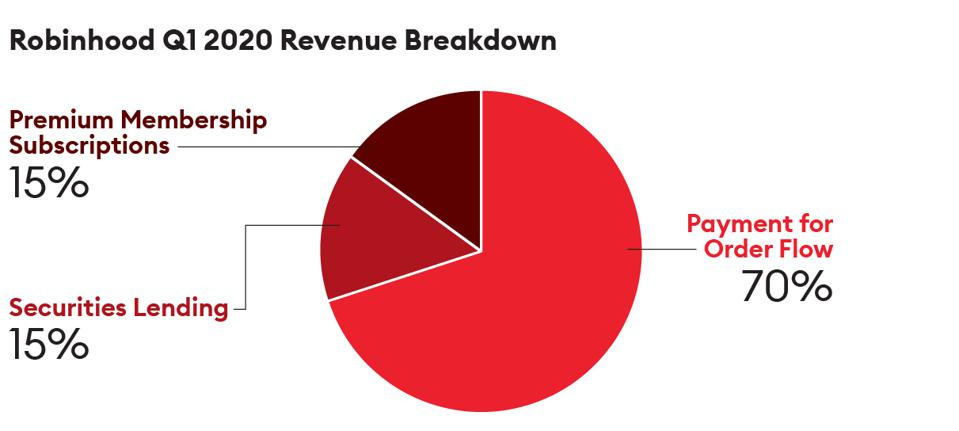

When you place an order to buy, say, TSLA on Robinhood you might think that Robinhood finds a seller to match or routes it to one of the major stock exchanges. In fact, they sell the right to execute this trade to other companies, primarily high frequency trading (HFT) firms like Citadel and Virtu. This practice is known in the industry as Payment for Order Flow (PFOF) and is somewhat controversial, depending on whom you ask. These companies pay Robinhood fractions of a penny for every share routed to them. These fractions of a penny add up: in the first half of 2020 Robinhood's total revenue from PFOF was $280 million.

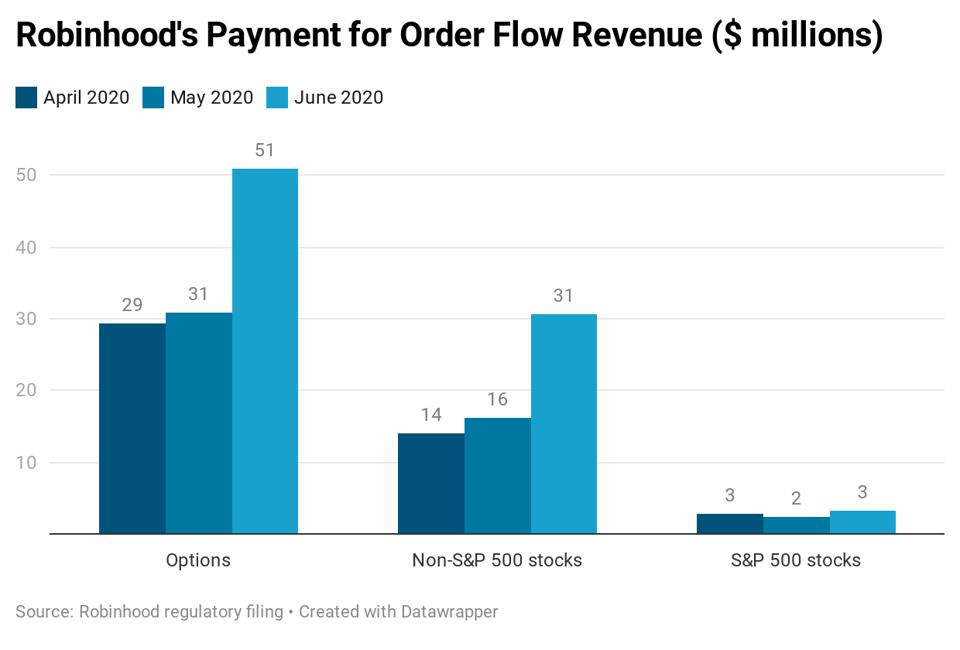

The other important thing to know now is that not all trades are created equal from a PFOF perspective. In general, options trades are more profitable to execute, and therefore Robinhood gets paid more for options trades than they do for regular stock trades on a per-share basis (by some estimates over 3x more).

Don’t worry about the details of PFOF yet, we’ll get into that later. For now all you need to know is:

More trades = more revenue for Robinhood; and,

More options trades = even more revenue for Robinhood.

[Source]

Robinhood has other revenue streams (and even has a support page explaining how they make money, which might be a clue that the company knows its transparency is lacking), but we'll focus on PFOF as it is the biggest and most interesting.

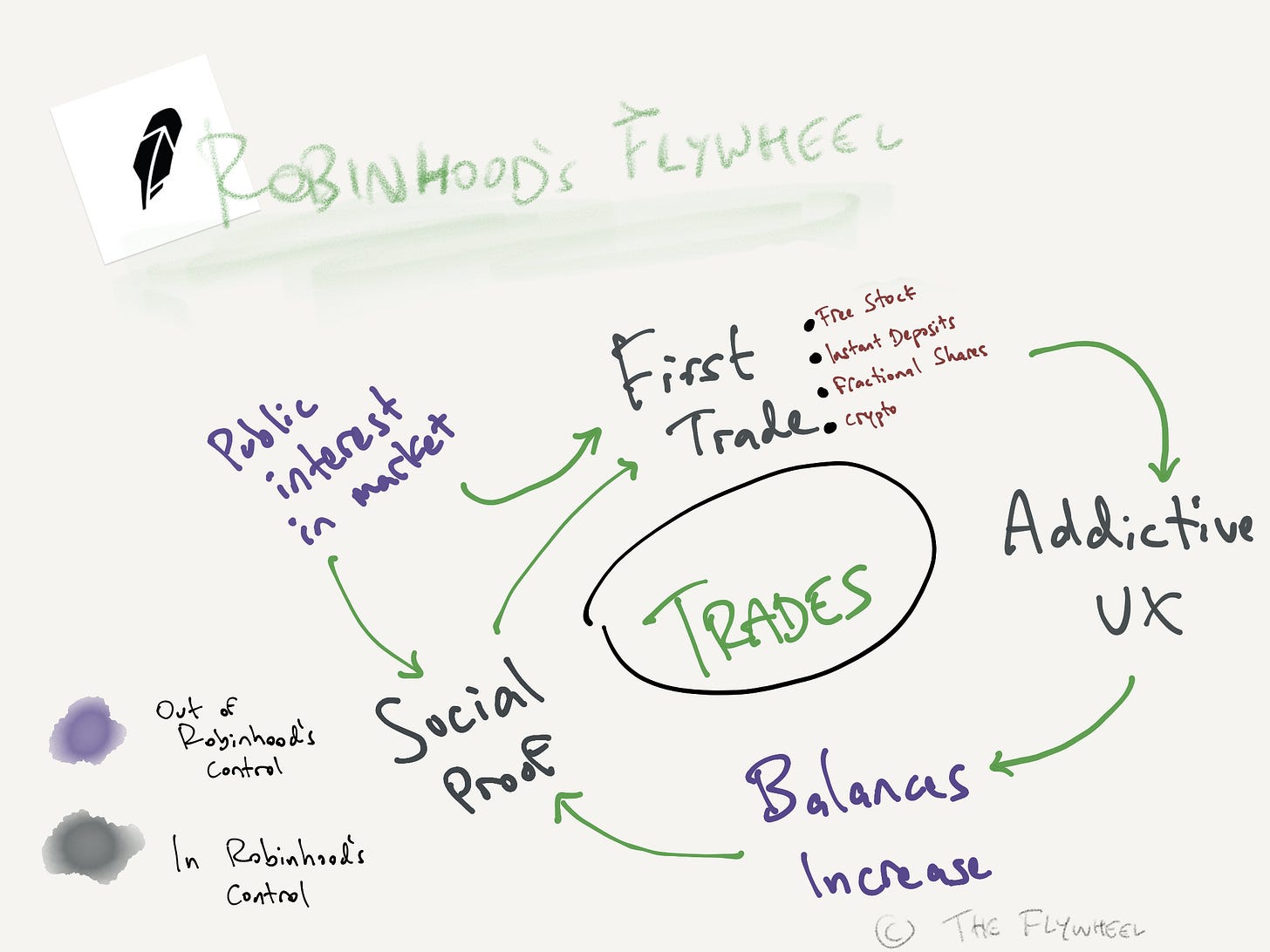

Now that we understand this, we can understand Robinhood's incentives. Robinhood has a direct interest in encouraging its users to trade more generally, and to trade more options specifically. With this understanding, we can sketch out the Robinhood Flywheel.

Robinhood's Flywheel

The First Trade

Robinhood's flywheel starts with a focus on getting a new user to sign up and make a trade. That’s not necessarily unique to Robinhood. What is, though, is Robinhood’s approach to eliminating friction. What started with free trades has evolved into a list of features, all designed to make it as fast and cheap as possible to get started:

Free trades: this was the core, killer feature from day 1 that allowed Robinhood to amass a 1 million person wait-list before the product even launched. It seems obvious only in hindsight, but having to pay a commission per trade was a huge pain point for tons of people.

Free stock: new users are given one share of a cheap stock to entice them to get involved. Since about half of Robinhood users have never owned stock before, the free stock punches well above its weight in terms of what it costs Robinhood.

Instant deposits and margin: traditionally it can take several days to set up and fund a new account with a financial institution. Not so at Robinhood. Users are given access to instant funds while their deposits are pending, and if they need more they can easily borrow on margin.

Fractional shares: Robinhood knows that many of its users are young and may not have much income. Many can't afford a share of Amazon at $3,000, but can get a piece of the action for as little as $1.

Cryptocurrency: shortly after the Bitcoin/crypto craze in late 2017, Robinhood announced that it was adding free cryptocurrency trading to its platform. By the end of the first day they had over 1 million accounts on the waitlist.

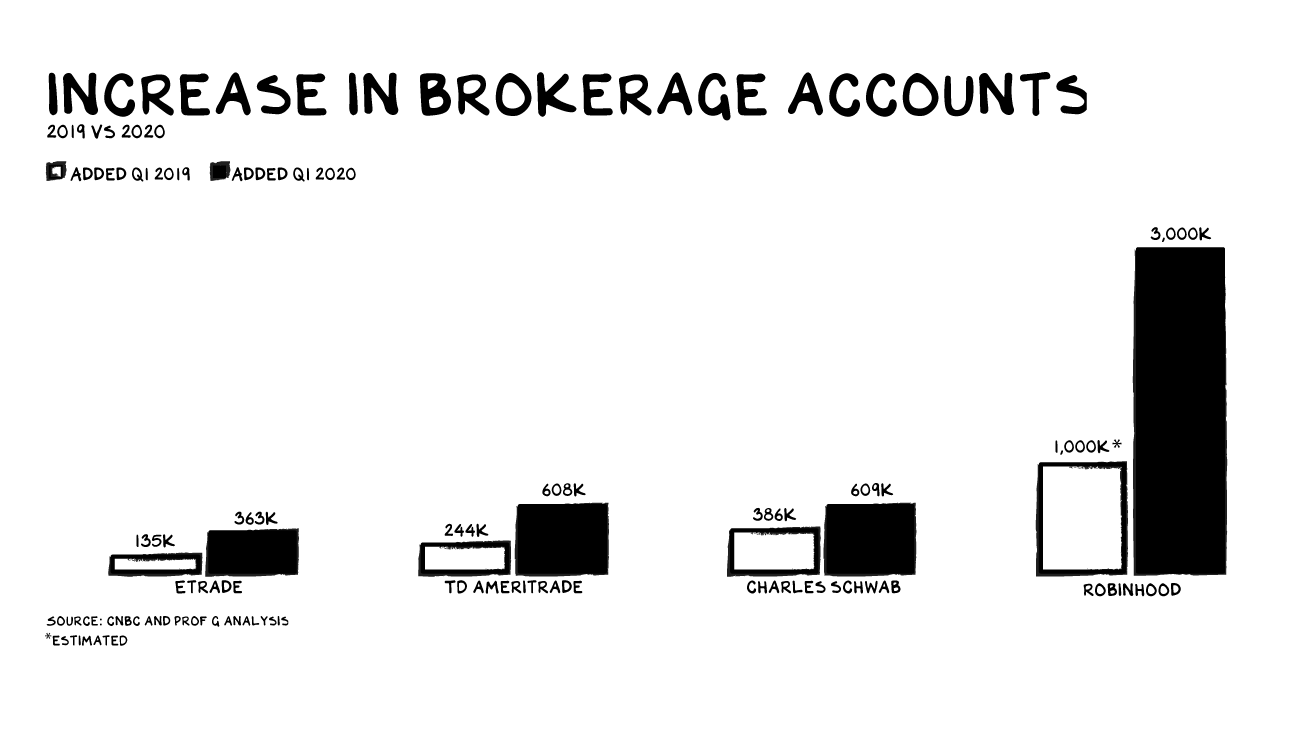

Demand for market access: this one isn’t actually a Robinhood feature, but it’s still worth mentioning. Although not in Robinhood's control, there's no denying that the past year has seen a surge in interest in the markets. And with all the features listed above, it’s not surprising that Robinhood saw the biggest share of this growing pie (Source):

Delightful and Addictive UX Design Leads to More Trades and a Foray into Options

If it is the free stock or free trades that compelled users to sign up, it is Robinhood's design that hooks users. The app has been likened to highly addictive entertainment products like slot machines, Candy Crush, and Instagram. My former professor Scott Galloway goes into more detail on the addictive nature of Robinhood's app.

Robinhood's approach to designing a trading experience was unique when it first launched. Get this: they actually wanted to make it easier and more fun to trade than legacy brokerage firms. The entire experience is built to eliminate any and all friction.

But as is the case with many binge-worthy apps, the line between delightful and addictive is blurry. You could argue they go too far (and many do). After a user's first trade confetti falls down from the top of the screen. This is a strong but subtle message that 'trading feels gooooood'. Later users will encounter experiences that make it easier to complete a trade than to cancel it. They'll see stock recommendations as if this was Netflix. The buttons to trade options will be placed above buttons to simply buy a company's stock. All of these combine to create a powerful psychological pull to keep trading, and to take on increasingly more risk.

Up and to the Right

There's no getting around the fact that Robinhood has only been around in a bull market. Users have grown accustomed to seeing their balances grow. The memes have been plentiful, and it's been hard to ignore the euphoria pervading casual traders like those on Robinhood. The market shrugged off an initial crash in March and the stonks only went up.

As people's balances grow, the FOMO gets real. Burton Malkiel paints a great picture of this in A Random Walk Down Wall Street: it’s pretty hard not to trade when it seems like everyone is getting rich. Of course this, too, is not in Robinhood's control, but as people make money on Robinhood, the word of mouth becomes more and more pervasive.

The good news is that there's an app that will offer you a free share to get started! And on the Flywheel spins..

Robinhood and Ethics

The rest of the article will cover new ground for The Flywheel. Until now we've followed the Flywheel with a discussion of 'how good or bad is it for the company'. In this case, I'll focus on 'how good or bad is this for customers', because for the first time in our short history together, these are two different questions.

There are two areas I'll touch on here: its main revenue driver (PFOF) and the ethics of designing addictive apps for trading options.

PFOF

As we discussed, Robinhood makes the majority of its revenue from Payment for Order Flow (PFOF). PFOF means that when a customer places an order on Robinhood, a 3rd party (typically a high frequency trading firm or HFT) pays Robinhood a small amount for the right to execute that trade. The only reason they are willing to pay for that trade is because they can turn around and make money with it. In other words, if you place an order to buy a share on Robinhood, the HFT can make money by buying the shares from somewhere else at a cheaper price and then selling them to you. If you want to learn more about the mechanics of PFOF, I recommend this primer.

PFOF is a bit of a confusing topic, and there's major debate about whether it's good or bad for investors. Detractors of PFOF claim that every penny of profit made by the HFT comes out of the pocket of investors (the UK and Australia seem to be in this camp as the practice is outlawed in those markets). Defenders say it's still cheaper than paying commissions per trade, and that having someone always there to buy from and sell to is a net positive for small investors. From Bloomberg:

Retail brokers and trading firms say that the payment for order flow system is a win for retail customers, who have never been able to trade more cheaply. They argue that the payments help keep broker fees lower than they’d otherwise be. And they note the payouts are no secret: Any brokers that accept payments from trading firms must publicly disclose both how much they receive and how well customer trades were handled. Critics of the system argue that it sets up a conflict of interest, and that brokers may be tempted to funnel orders to the firms that dangle the most cash for their customer orders instead of firms that regularly trade for the best price.

In other words it's either great or you're getting ripped off. That sure clears it up! I don't have a strong opinion on this personally; there are lots of good articles that argue both sides that I welcome you to search for. What I’d rather discuss is how PFOF impacts Robinhood's incentives:

Payments Relative to Other Brokerages

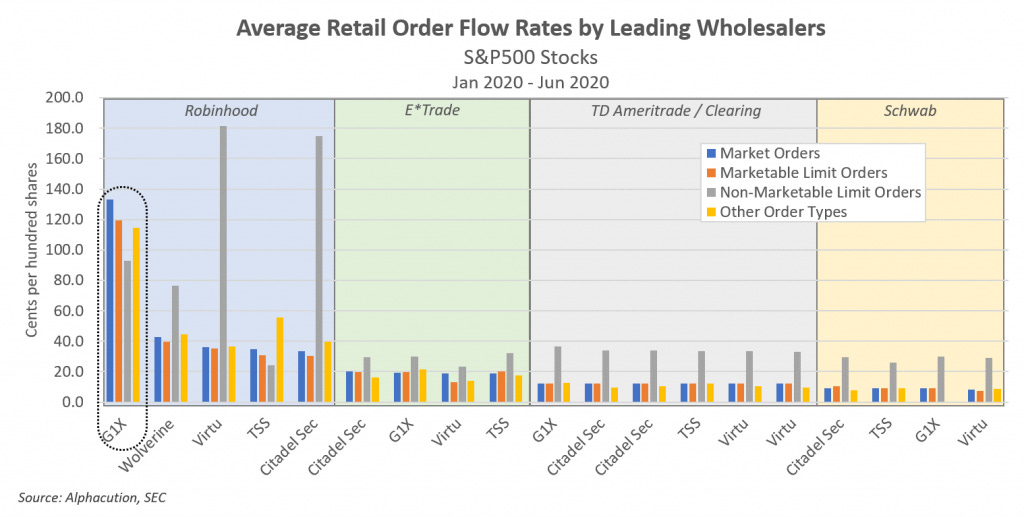

Robinhood didn't invent PFOF—although the names Bernie and Madoff are involved in its actual origin story, which may explain in part why PFOF is considered sketchy—and is not the only firm engaged in the practice. What is strange is that the HFT firms pay 5-100x more per share to Robinhood than they pay to Schwab or ETrade.

Per the NYTimes: "In total, Robinhood got $18,955 from the trading firms for every dollar in the average customer account, while Schwab made $195."

Why would a HFT pay more for the right to execute a trade to one brokerage over another? I don't entirely know. But if it is true that every penny made by HFT comes from the pocket of the original trader, then traders are giving up the most when they use Robinhood.

Options are Worth More

You see those grey bars in the chart above? Those represent options trades. This gives you a sense for just how much more lucrative options trades are for Robinhood compared to other types. Because of this pull, Robinhood's incentives to lure customers to increasingly dangerous behavior are stronger than for other companies, and is proving to be irresistible. This leads me to the next point:

Dangerous Territory

In general, the more a small investor trades, the worse their investment performance is likely to be. This is a well studied effect (here is one example of a paper from 2000), and is why the conventional wisdom when it comes to investing is to set it and forget it.

On top of the overall danger from encouraging too much trading is the specific incentive Robinhood has—unique in the market as shown above—to lead users to trade options. Options are a significantly higher risk, higher reward way to gamble on the market. Compared with just buying a company’s shares, the same company’s call options (which is also a bet that the share price will go up) are much more likely to go up a lot, and also much more likely to go to zero.

For sophisticated investors, there are ways to combine option trades in order to reduce risk, but those are hard to understand for most people. For example, it is believed that confusion stemming from a 'bull put spread' trade placed in Robinhood led to the suicide of a 20-year old college student in March. It's one thing for people like my brother, a professional trader, to be dabbling in these types of trades. It's quite another for young kids with no income and no investing experience to get into this much trouble from a few simple taps.

Why does this matter?

Ultimately, I believe there could be a real reckoning coming for Robinhood. Recall how Robinhood's flywheel had a couple of important pieces that were outside its control. At some point the market is going to turn, and at some point you're going to see more horror stories of kids who lost insane amounts of money trading on Robinhood. I truly hope we don't see more suicides.

Robinhood's proponents do indeed have a valid case that, with millions of new people entering the market, finance is becoming more democratized. The barriers to getting started with investing have well and truly been removed. Folks who never before could participate in the markets now can. Let's return to company lore for a moment. Remember that whole stealing from the rich and giving to the poor thing?

What if the real story is a little different. What if instead, we focus on the cofounders' previous venture, which was building software directly for HFT firms? Maybe during that time they learned that what HFT firms really need is a larger, steady volume of 'dumb money', and built the ultimate trap—dark UX patterns and all—for young people to start trading in?

What if instead of having some long term vision to democratize finance, the cofounders willfully diluted themselves (by some reports they own less than 10% of the company now) by raising billions in a hopeful, get-rich-quick scheme that is rushing to catch the IPO window before it closes?

How ironic would it be if the company started as the heroic face of post-Occupy Wall Street financial democracy becomes instead the villainous face of the next bubble bursting?

What's so amazing here is that it's actually, truly ambiguous. Like so much in today’s society, the same exact set of facts can be interpreted differently depending on one’s perspective. You could legitimately tell the story either way. It's up to you to decide.

That’s it for this edition of The Flywheel. Thanks so much for reading. A huge thanks to Marni, Seth, Tanya, Nate, and Noah for proof reading.

If you liked this article, please subscribe and share with a friend!

What’s your take on Robinhood? Feel free to share you thoughts with me on Twitter here.

Jake! miss you bud. Great stuff! Consider whatever consumers loose through PFOF they probably gained considerably more from free trades! Also, on a macro level, inequality is caused/enhanced by the difference between the (historical) return on capital and labor. Robinhood made it cool to invest, god bless them. Now, more people will have capital gains. In the long run, Robinhood is a hero.

Definitely seems like a net negative outcome for new investors. Maybe they can figure out how to create that dopamine rush from saving pennies, saving on fees, and squirreling them away in a set-it-and-forget it fund that's more likely to actually build wealth?