Peloton's Food Network Opportunity

Why Peloton should be more focused on turning their instructors into stars and their users into fans.

Welcome to The Flywheel, where we take a look at a company’s product portfolio to understand which areas of the business are spinning smoothly and where a little grease may be needed. Learn more about The Flywheel here.

If you’re reading this but are not subscribed, consider joining us to receive every new Flywheel article (1-2 times per month) directly in your inbox!

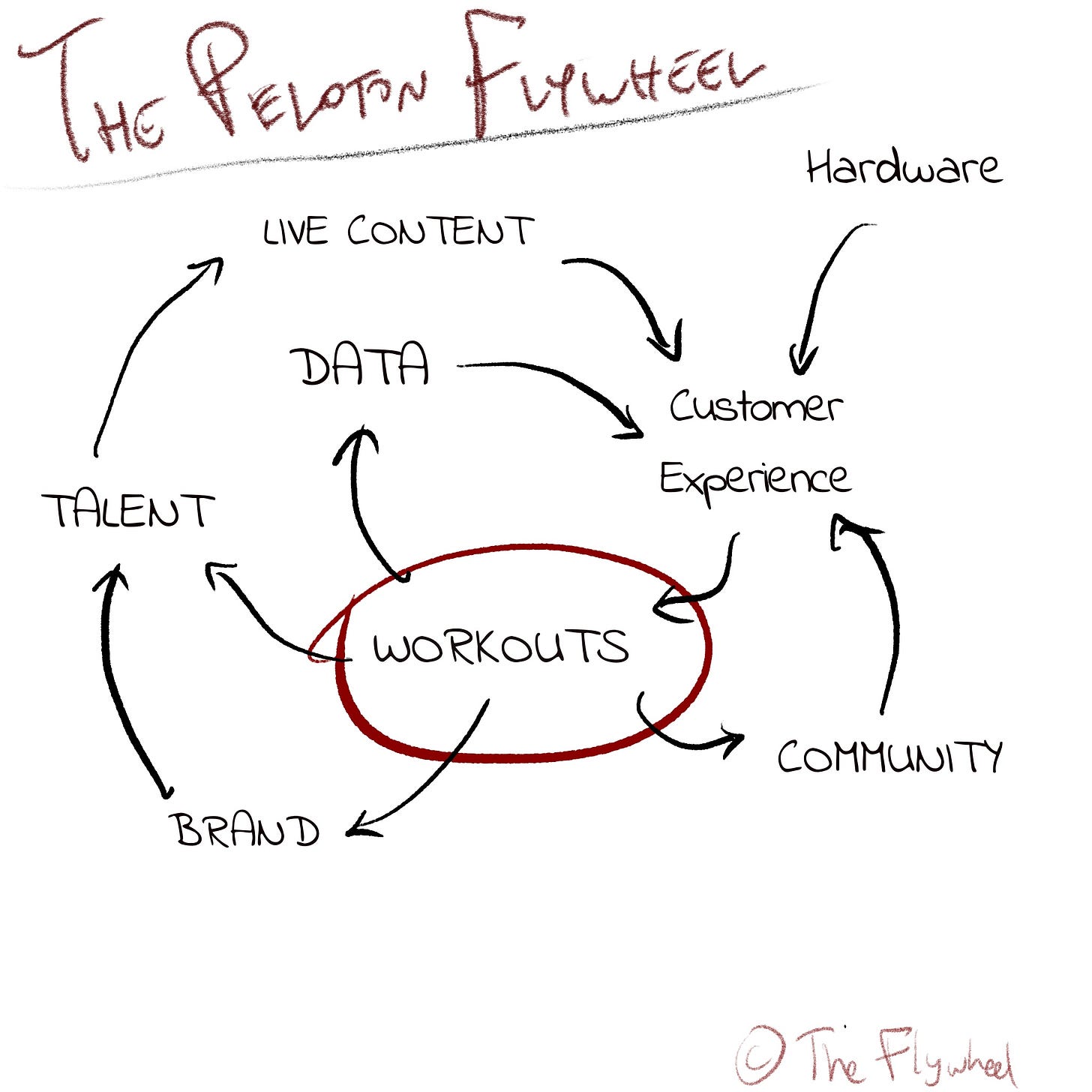

TL;DR: Peloton’s flywheel has worked well for its bike product, but is sputtering when it comes to its other hardware and digital products. Peloton needs to invest in its talent, its community, and its data in order to keep the flywheel spinning for the foreseeable future.

Full disclosure: I own a modest amount of PTON shares.

Peloton’s Flywheel

At first glance, Peloton seems to be a relatively straightforward business. They sell connected bikes and treads and produce live content to go along with them. The expensive hardware purchase locks customers into a recurring subscription for the life of the device. Peloton is proud of its low churn rate, but you also wouldn’t expect many to churn after paying $2,000+ for a piece of exercise equipment. I figured that, like a gym membership, customers would purchase a Peloton and then slowly let it collect dust in their $3 million apartments.

But then I saw a data point that surprised me: the average monthly workouts per subscriber keeps going up.

[Note: A few people have made the point that these numbers might be inflated because of COVID-19, but I think not: Peloton’s fiscal Q3 2020 ended on March 31st, 2020, just barely into the pandemic].

Assuming no funny business with the accounting, and assuming people in general haven’t all of a sudden started working out more, this suggests that the product itself is compelling people to work out more over time. It suggests the existence of some kind of flywheel that is pushing Peloton in a positive direction.

Peloton’s original S-1 from 2019 (it’s hard to believe Peloton has been a public company for not even a full year) offers the following:

We are a technology company that meshes the physical and digital worlds to create a completely new, immersive, and connected fitness experience. We are also:

…a media company that creates engaging-to-the-point-of-addictive original programming with the best instructors in the world.

…an interactive software company that motivates our Members to achieve their goals.

…a product design company that develops beautiful and intuitive equipment that anticipates the needs of our Members.

…a social connection company that enables our community to support one another.

…a direct-to-consumer, multi-channel retail company that facilitates a seamless customer journey.

…an apparel company that allows Members to display their passion for Peloton.

…a logistics company that provides high-touch delivery, set up, and service for our Members.

We are driven by our Members-first obsession and we will be any company we need to be in order to deliver the best fitness experience possible.

This post defines the Peloton flywheel, and uses it as a tool to suggest where the company should focus moving forward.

Peloton’s Flywheel: The Secret Sauce behind the Bike

Live content + high quality hardware create a great customer experience

This is the foundation of everything at Peloton, and was there from day 1. The reason an early Peloton customer adopted was not just because there was streaming content, and it was not just because there was a new stationary bike on the market. It was the combination of the two—unique at the time—that drove early adoption for Peloton.

Live content motivates you to work out, the hardware keeps track of all the important details, and the software connects the two to create a powerful experience. Live content is added to the catalog the moment a class ends, continually enriching the customer experience.

As the customer experience gets better through more live content and hardware, more people work out with Peloton.

This is the main engine: as the customer experience gets better, more people work out with Peloton, and, as it turns out, people also work out more often with Peloton than they did before. This is the interesting part, as multiple things are driven from the volume of workouts:

As more workouts happen on Peloton:

A community is developed, both between the rider and the instructor and among riders.

Peloton collects increasing amounts of data that can be used in a variety of ways to make the experience more compelling.

The Peloton brand increases in value in the eyes of existing customers. Each ride serves as powerful marketing content for Peloton itself.

Instructor talent is increasingly attracted to Peloton, as the growing audience provides increasing opportunities to become a celebrity.

Each of these offshoots has its own tie back to the flywheel:

As the community grows, the customer experience improves, which drives more workouts.

The difference between a live ride on Peloton and watching a static video workout is the community. Peloton’s social features create an environment where the more users are riding, the more compelling the ride. These include the leaderboard, high fives, and instructor shoutouts.

As Peloton collects data, it improves the customer experience, for both future and past rides.

Once a ride has been recorded, Peloton annotates the ride with additional features (suggested resistance and cadence, for example), that makes the previously recorded rides potentially even more compelling than when it is live.

Furthermore, each user’s individual data is used to improve the product, whether through ride suggestions or a shadow version of your own best output to chase on the leaderboard.

As the Peloton brand increases in value, talent is increasingly attracted to the platform.

Peloton wants its instructors to be likeable, good looking, and capable of attracting an audience. As Peloton becomes a more prominent brand, their ability to attract both full-time and guest instructors who drive significant traffic for the company will increase.

It’s not included in the graphic, but apparel is a secondary opportunity that becomes more feasible as the brand value increases.

As the instructor talent improves, the live content improves.

The charisma and motivational abilities of instructors is a significant driver of engagement for Peloton, and as the instructors become more famous, they increasingly improve the quality and desirability of live content.

The Problem: Tread + Digital Lagging Behind

Peloton has aspirations to be more than a one-product company. With a $19B market cap, shareholders expect nothing less. Does the flywheel that has served Peloton so well up until now allow for a seamless transition to becoming a fitness ‘platform’? I argue that some changes are needed:

Reliance on Hardware

Peloton launched a treadmill in 2018. It’s unclear whether more than a handful of people have bought one. A few reasons to be skeptical of the treadmill’s success:

The bike has about 32x more reviews on Peloton’s own site than the tread does.

I took a cursory glance at recent bike rides and treadmill workouts, and compared the number of ratings each had (users are prompted to rate a ride as soon as its finished). Bike rides on average had 4-5,000 ratings within 2 or 3 days. Tread runs had fewer than 200.

I ordered a Peloton bike in late April, and it was delivered in mid-July. At the same time—out of curiosity—I added a treadmill to cart. Peloton estimated delivery within 1 week. Demand is obviously much higher for the bike than for the tread.

So if we call the tread a flop, what does that have to do with the flywheel? Peloton has leaned heavily into its digital-only offering. Anyone can subscribe for unlimited access to Peloton’s streaming classes for about 1/3 the price ($12.99/month) of the bike or tread membership ($39.99).

The problem with this, is that it’s similarly unclear whether the digital offering is working. A few reasons why I’m skeptical:

This past Q3 was the first time Peloton reported digital subscribers separately; they claim they have 176,000 digital subscribers. This is 20% of the number of connected device subscribers, which strikes me as low—considering it costs $13 a month with no hardware purchase up front, if the digital only product was actually any good, I would imagine they would have a lot more subscribers than this. 176,000 paying members would be a good start if churn were low, but I doubt it because..

In Peloton’s investor documents, churn is only reported for connected device subscribers—it explicitly excludes digital-only. My guess is churn is extremely high for the paid digital subscription because..

I’ve taken the digital only classes on my Roku, specifically yoga—they are not better or different than taking a free Youtube class in any real way. My girlfriend and I have switched from Peloton Yoga to Yoga with Adrienne and others on Youtube because there’s more choice and the classes are better.

The (admittedly speculative) digital-only struggles highlight Peloton’s reliance on hardware, and its first big, post-bike bet appears to be a flop. This is a problem because at some point 2-4 years in, the bike will break down, and users will have an opportunity to explore other options.

This is a big risk for Peloton because it hasn’t used its talent, community, or data to lock users in as effectively as it can. It seems Peloton needs to reduce its reliance on hardware successes, and focus on making their overall ecosystem work regardless of the type of workout. Let’s look at each of these areas and my suggestions of where the company should focus next.

Talent

The talent aspect of Peloton is one of the more fascinating. Are Peloton instructors fungible, or are they critical stars who carry the show? And based on this, how should talent be cultivated, treated, and compensated?

Maybe it’s a mixed bag. A brief glance at the data: I looked at some rides that took place about 8-9 days before publish, and checked how many ratings users left (a good proxy for how many users have taken the ride). This is far from a comprehensive analysis, but there appear to be clear tiers: Cody Riggsby and Alex Toussaint’s rides are pushing 40-50K ratings. The middle tier has instructors like Leanne Hainsby and Ally Love, whose rides get 10-20K ratings. Then at the bottom, you have folks like Christine D’ercole and Sam Yo who get in the 4-5K range.

This tells me that there is a small number of instructors who are carrying the platform for Peloton. I don’t know how Peloton instructors are compensated, but I’d have to believe that the top handful of instructors are underpaid compared to the value they create for Peloton.

Peloton’s Food Network Opportunity

Peloton should take a page out of The Food Network’s book and become star-makers. They need to think of their customers more like fans, an audience not just a user base.

Alex Toussaint could be the next Bobby Flay; Cody Riggsby the next Guy Fieri. Peloton should phase out less popular instructors (or move them to the workout equivalent of Sunday mornings), and experiment with new ones—maybe even getting the audience into it a la The Next Food Network Star. Give the top stars more equity in the company so they have no reason to ever consider leaving.

Most importantly: take these stars and cross-program the hell out of them. Have these stars teach non-hardware classes so that users have a real reason to use the digital-only offering.

Community

Peloton is only scratching the surface of its potential to cultivate community. The existing features do connect users to one another, but in a shallow and superficial way. High fives during rides are fun, but they disappear as soon as the ride ends. I know at least 10 people who have Peloton bikes, and my experience is no better because of it. Groups who want to ride together have to coordinate separately to do so.

Peloton can do so much more to cultivate an actual social network through its rides—people are practically begging for it. Rather than leaning into the passionate communities popping up around the product, Peloton appears to be suppressing them.

Today, if a user were considering switching from Peloton, it would be hard to argue that the community is a reason not to. Peloton needs to improve this, and here’s how:

Community Features

Make it so that if I am riding or working out at the same time as friends, I actually have more fun. This could be through features like zoom-esque video chats or voice calls. Cultivate online community by enabling instructors to engage with fans on Facebook and Reddit, and offline community by organizing Peloton Week events all over the country.

Acquire Strava

Strava is a leading app for bike riders and runners to connect, follow each other, and encourage one another to improve. Sound like a good fit for Peloton? I think so.

Data

Peloton collects thousands of data points per user per ride. And how is it used? Today, sparingly. Peloton tracks my milestones (10th, 100th, 1,000th ride), and publishes my metrics (heart rate, cadence, resistance, output, distance). But my experience on Peloton barely gets better over time specifically because of this data. I believe there’s a substantial opportunity to help users achieve their fitness goals through experiences that are increasingly personalized over time.

Peloton should lean fully in to the wearables movement to connect all types of biometrics into workout suggestions. Peloton may track my heart rate during a ride, but they certainly aren’t giving me insights based on it, nor are they monitoring my recovery after the fact. More critically, Peloton has no idea what’s happening when I do a non-bike workout. This is a huge gap for Peloton’s fitness tracking oriented users.

There are certain products that have so much useful data about a customer that customers never want to leave—Peloton is not that kind of product today, but easily could become one in the future. They could accelerate this future by acquiring Whoop and including a free wristband with every new hardware purchase.

That’s it for episode 1 of The Flywheel. Thanks so much for reading. If you liked this article, please subscribe!

And if I missed anything or you have any feedback, hit me up on Twitter or leave a comment.

It's interesting that you mentioned Community as a highlighted area of improvement, especially around "what users want," and the communities/channels they engage in. Just saw a talk by David Packles (Director of Product at Peloton), where they talk about how they are utilizing these channels for insights for building new products. (https://www.youtube.com/watch?v=1-KatWuirn4)

Seems like they're addressing the "what users want" part, but I agree that continuing to build and foster relationships with customers is important, instead of just looking into the fishbowl.

A couple things I'd consider with Peloton based on myself as a customer...

1. Lean in to the scenic rides/runs/etc. more as well. I like the classes but sometimes I just want ride by myself and the digital content could ultimately be cheaper to create.

2. Lean in to tracking fitness that happens outside the house. I'd never buy the Tread because running inside too boring for me and it's way too expensive. However, capturing my time outside running (which you can do), kayaking, SUPing, etc. gives a better overall idea of my fitness. I might even consider an acquisition of a company like Strava which already does a lot of this and merge the products.