Death and Turbotaxes

Why Americans spend so much time doing their taxes, and why not all flywheels are happy flywheels.

Welcome to the new subscribers! A belated happy Passover and Easter—and early Ramadan—to anybody celebrating! If you’re reading this but haven’t subscribed, click below to join 3,250 (🤯) of your smartest friends and peers who receive The Flywheel in their inbox every other Tuesday. More or less. Lately, less. Will be sharing some exciting updates on that topic in a few weeks.

Today’s piece is a specifically US oriented piece about a very American ritual: Tax Day. For the ~25% of you who live outside the US, I know you’re laughing at us, but do you have to do it so loudly? Onto the article..

If you’re anything like me, this is approximately what your annual tax journey feels like:

Late February, the looming tax deadline enters my consciousness, and I wonder why our taxes are so complicated. I get preemptively anxious about the entire process. I think to myself: I should do my taxes early this year.

In March, I recall the Planet Money episode I loved about how TurboTax has opposed making our tax code simpler for decades, and get angry at TurboTax and its parent company Intuit. I vow not to use TurboTax this year.

In early April, I research alternatives, and I remember that one, truly awful year I tried H&R Block. I forget why I was reluctant to use TurboTax.

On April 14th, knowing I left it too late, I just go for it on TurboTax. I’m greeted with “welcome back, Jacob, for your 7th year with TurboTax”.

Before the process starts I calibrate: is this a refund year or an extra tax year? Either way, $129 seems like a fair price to be done with taxes within the next few hours.

Do I need audit defense? I probably need audit defense. Another $40.

Submitted! Feeling a weird mix of relief and..is that pride? Patriotism? Weird. OK, that could have been worse. TurboTax? Pretty slick product.

Forget it ever happened…until next year.

I’ve been in this cycle for the past 10 years, give or take. But this year, I have The Flywheel, and I fully intend to use it.

In today’s piece we’re going deep on taxes. Sounds fun, doesn’t it? We’re going to look at how Intuit took the US taxpayer hostage, how it has entrenched the system so that the status quo remains in its favor, and what a potential solution might look like. By the end of this, my goal is that we’ll all be rage-doing our taxes together.

To understand what this is all about, we need to go back almost two decades and give some deep context on a public-private initiative that is at the center of the individual tax-debate in the United States: Free File.

Free, Free, Free, Free, Free

Our story begins back at the turn of the century. And by that I mean the turn of the millennium, when the government was starting to ponder how it might digitize its services. Think dotcom boom, the internet becoming as a thing, and new possibilities emerging.

Before the internet, people had to mail their tax returns to the government. Imagine the current process plus mail. Yeesh. So in 2002, the Office of Management and Budget (OMB) under the Bush administration tasked the IRS with creating a free, automated, and digital filing system that would help the tens of millions of Americans whose taxes are considered straightforward (i.e. income mostly from W-2 paychecks, and no itemized deductions) file for free.

Thing is, the tax prep industry was a big business. Remember those physical boxes of TurboTax on the shelves at every Best Buy, Office Depot, and Walgreens? And Intuit, parent company of TurboTax, had a leadership position in the market. But suddenly a potential new competitor emerged that could bring down the entire business: the US government.

Conveniently, the IRS commissioner at the time became concerned that this digital overhaul was too difficult for a puny federal agency like the IRS. But the federal government was still interested in providing a way for Americans—especially lower income Americans—to file their taxes.

Intuit seized upon this opportunity with a suggestion: in a noncompete that even the most aggressive FAANG lawyers would call daring, the IRS agreed to never compete with Intuit (and the rest of the interest) directly with its own tax prep software, and in exchange the industry would offer free tax services to poor Americans, under an consortium that is now known as the Free File Alliance.

Intuit’s biggest threat—that the government would provide a basic service to its citizens for free, as other countries do—was neutralized, at least for now.

It’s notable in all the articles I’ve read that it just assumes that tax filing should be free for people with income below a certain level. I still haven’t found a good answer to why it shouldn’t be free for everyone. If you have any ideas about this, let me know!

Not so “Free File” Participation

A partnership in which free tax filing services are offered to those who need it most seems like a great idea. Let’s look a bit deeper at how it’s going.

For its part, Intuit thinks it’s working great: “Free File has been a successful program and partnership that’s benefited millions of taxpayers.”

They also market the crap out of it. Have you ever seen one of the hundreds of ‘Free, free, free, free, free’ commercials that have polluted our airwaves over the last few decades?

I guess it must really be free to file one’s taxes on TurboTax!

Yet, most estimates show that only about 3% of Americans who are eligible to file for free end up doing so, and that over $1B is wasted by these—our poorest citizens—as a result.

Let’s recap: Intuit said ‘don’t worry about creating tax prep software for your citizens, we got it, and by the way here’s a contractual obligation not to compete with us’, the IRS agreed, and now only 3% of eligible people are taking advantage of the offering. What’s going on here?

Turns out, Intuit was a bit sneaky: they agreed to offer the service, but they were under no obligation to promote the service in any direct way. In fact, they went further. They deliberately hid the free filing service and instead pointed users toward its paid ones.

But the commercial said “free” at least 20 times! Next you’ll tell me that 15 minutes actually can’t save me 15% or more?

The problem goes back to the beginning of Free File: in the agreement, the government dictated the eligibility rules only. In other words, they said ‘anybody making less than $X must be able to file for free on one of your sites’, but they otherwise left the implementation details up to private industry. The companies were free to encourage or discourage participation as they wished. And as companies who make money when people pay to use tax prep software, the incentive was clearly to discourage it.

Let’s look at two very deliberate tactics Intuit has employed to keep participation in Free File so low: (1) Dark Patterns, and (2) search result suppression.

Dark Patterns

I talked about Dark Patterns in my Robinhood piece, so I won’t go into much depth here. But Dark Patterns are powerful. In general, people are usually browsing sites and completing tasks on their computers with something less than 100% of their focus and attention. App designers have a lot of power to guide users via subtle suggestions towards whatever they decide is important.

Tax reform crusader ProPublica detailed some of the dark patterns built by TurboTax in its attempts to funnel free-file eligible taxpayers to their paid products.

We started the process by creating the profile of a TaskRabbit house cleaner who took in $29,000. We entered extensive personal information. TurboTax asked us to click through more than a dozen questions and prompts about our finances...then we tried with a second scenario. We went back to TurboTax.com and clicked on “FREE Guaranteed.” This time, we went through the process as a Walgreens cashier without health insurance, entering personal information and giving the company lots of sensitive data.

In both cases—SORRY—not eligible for free tax filing with TurboTax. “It turns out that if you start the process from TurboTax.com, it’s impossible to find the truly free version.” I’ll reiterate: it is physically not possible to start on TurboTax’s home page and complete your taxes for free.

The article goes into more details, but the definition of a dark pattern is when an experience is deliberately set up to steer users away from what they actually want to do, and towards what the company wants them to do.

Is this deliberate? Is this just poor UX? Evidence seems to be that it’s deliberate. ProPublica got some quotes from former employees, that “dark patterns are something that are spoken of with pride and encouraged in design all hands”. Intuit in general invests heavily in UX (see ‘software’ section, below), so it seems unlikely that these were accidents.

If you’re not convinced yet, let’s look at the next set of facts:

Search Result Suppression

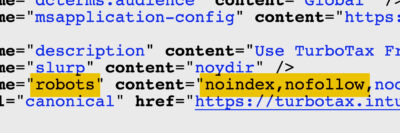

ProPublica continued its hard hitting series of investigative, Intuit journalism (if you’re wondering whether Intuit ever got angry about this series of articles, the answer is yes) by describing how Intuit injected code specifically to suppress its actually free service from Google search results.

The code in question, which can be found in a file called robots.txt or in an HTML tag, has to be actively added to a site, as Intuit has done. It is typically used on pages that designers want to hide from the open internet, such as those that are for internal use only. Without that code, Google and other search engines default to adding a site to their search results.

“Robots.txt is a big ‘No, don’t go any further’ sign on the web,” Spool said.

The code on TurboTax’s Free File site says “noindex,nofollow” — instructions for it not to show up in search results.

The IRS eventually had to actually update the language of the Free File agreement in 2020 (18 years after the program started) to explicitly prohibit this type of behavior. I wasn’t able to find anything about repercussions faced by anyone involved.

ProPublica’s scathing history of this story summarizes the situation well: “Since Free File’s launch, Intuit has done everything it could to limit the program’s reach while making sure the government stuck to its end of the deal.”

How does Intuit’s active work to suppress usage of its truly free products feed into a flywheel? Let’s dive into it:

Intuit’s Dastardly Flywheel

Intuit makes billions of dollars each year by funneling people who would otherwise file for free into one of its paid services. It then turns around and uses that cash to entrench the existing system that allows them to earn said cash in the first place. Let’s take a deeper look:

Suppress Usage of Free

We’ve already talked about this at length, but it bears repeating: Intuit has a unique set of incentives when it comes to their business. They’ve entered into an agreement with the IRS to offer free tax filing and in exchange the IRS will not build and distribute its own free tax filing software.

The agreement doesn’t really define the word offer, though—at least it didn’t at first. The IRS seems to have relied on the good will of private industry. In reality, incentives tend to beat good will most of the time, and Intuit’s incentive couldn’t be more clear: limit the proportion of the population who files their taxes for free.

Revenue

Intuit’s TurboTax revenue in 2020 was $3.2B (representing 42% of total revenue). We saw estimates above that Americans who were eligible to file for free still ended up paying an aggregate of over $1B for tax preparation services.

We don’t know what portion of TurboTax’s revenue can be attributed to sneaky tactics that funnel free-eligible Americans to paying products, but it’s probably not negligible.

This massive influx of cash has juiced the stock price..

..and it has also allowed Intuit to build a pretty clever flywheel that entrenches it as the winner of this crazy game.

Free, free, free

First, Intuit spends a lot of money on marketing. In 2020, that figure was just north of $2B, or 26% of revenue.

This leads to massive awareness for the vague idea that filing taxes could be free on TurboTax—just at the right time of year—but the reality tends not to match up as we’ve seen.

Software

Another key to Intuit’s success—to their credit—is they’ve built some pretty fantastic software. Their tax prep stuff really is good. It auto-imports all my accounts, it carries over everything it knows about me year over year, and it makes the process about as simple as it can be.

They’ve managed to make completing one’s taxes almost (almost) fun, and it’s been well documented. Their product development is so good, that it makes people almost (almost) not question why it needs to exist in the first place.

Lobbying

Finally, Intuit has a big lobbying machine that fights every possible threat to the status quo of tax filing.

I’ll admit that lobbying is not a topic I understand well. For one thing, I don’t totally understand why it’s allowed. For instance, there is this quote from Intuit that “like many other companies, Intuit actively participates in the political process”, and I know this is meant to be breezed over, but I truly don’t get why this is such a fact of life in the US.

The other thing I don’t get about lobbying is why it’s so effective. When you look at the details of lobbying, it more often than not tends to amount to a lot of small contributions–$3,000 here, $800 there—and yet the impact seems to be far larger.

Despite my lack of understanding, the simple fact is that lobbying is a part of our process and it is effective. Intuit is one company who uses it to its full effect. In fact, Intuit lays out an annual strategy each year to combat government ‘encroachment’—in other words, stopping the government from simplifying the tax code and offering better services to its citizens.

The Planet Money episode discusses one specific example of a successful test in California of a return-free filing system—I highly recommend listening to it. In addition to more formal lobbying, Intuit has also implemented nefarious grassroots campaigns to get various minority groups to become anti-return free advocates.

There’s one more salient fact worth mentioning about Intuit’s success influencing policy: there appears to be a revolving door between the IRS and the tax prep industry executive ranks. Intuit’s recent Chief Tax Officer used to be a director at the IRS. About a decade ago, the IRS hired the former CEO of H&R Block to be its deputy commissioner.

A cursory LinkedIn search shows 22 people who used to work at the IRS and now work at Intuit and 10 people in the vice versa situation.

I’m not sharing this to out anyone or even to call Intuit out as an egregious offender. I’m pretty sure this is all relatively standard practice in the US.

But I do think it’s worth pointing out as a case study, because if we’re thinking about things from first-principles, it’s not clear that the system as is makes any sense.

Bye Bye, Tax Returns

If we’re sufficiently fired up at this point and wondering ‘what’s the solution to this problem?’, fear not. A visionary leader described in detail a very reasonable alternative to our current system:

“We envision a system where more than half of us would not even have to fill out a return. We call it the return-free system, and it would be totally voluntary. If you decided to participate, you would automatically receive your refund or a letter explaining any additional tax you owe. Should you disagree with this figure, you would be free to fill out your taxes using the regular form.”

Pop quiz time: which politician do you reckon said this quote, and when?

While you’re pondering, some more facts: it was estimated in 2016 that Americans spend 2.6 billion hours and $98 billion doing their individual taxes each year. Just to be clear, that’s doing taxes, not actually paying taxes. There are approximately 143 million taxpayers in the US, and so this averages out to about 18 hours and $600 per person.

Back to our pop quiz: who is the visionary leader who imagines a bold future where this burden is lifted from our shoulders?

Any last guesses..?

That’s right, it was the Gipper himself, conservative legend Ronald Reagan, all the way back in 1985:

Modern day politicians like Elizabeth Warren are still beating the drum, proposing bill after bill to remedy the situation:

“Taxpayers waste too many hours and hundreds of dollars on tax preparation each year, which disproportionately burdens low-income and minority taxpayers," Senator Warren stated. "This bill will require the IRS to offer easy, free, online tax-filing for all taxpayers. This is a simple idea with a long history of support from both Republicans and Democrats, and it's time to make it a reality.”

Return free filing has broad appeal for a few obvious reasons:

The IRS is already doing this work

When you submit your tax return, the IRS checks it against its own records and can automatically trigger a notice that you under- or over-paid your taxes (I learned this the hard way a few years ago).

How does that work? From VOX:

The actual work of doing your taxes mostly involves rifling through various IRS forms you get in the mail. There are W-2s listing your wages, 1099s showing miscellaneous income like from one-off gigs, etc. To fill out your 1040, you gather all these together and copy the numbers in them onto the 1040 form. The main advantage of TurboTax is that it can import these forms automatically and spare you this step.

But here's the thing about the forms: The IRS gets them too. When Vox Media sent me a W-2 telling me how much it paid me in 2017, it also sent an identical one to the IRS. When my bank sent me a 1099 telling me how much interest I earned on my savings account in 2017, it also sent one to the IRS. If I'm not itemizing deductions (like 70 percent of taxpayers), the IRS has all the information it needs to calculate my taxes, send me a filled-out return, and let me either send it in or do my taxes by hand if I prefer.

If the IRS is already calculating how much tax you owe, then why should we be spending all this time and effort to duplicate that work?

Most other countries operate this way

I highly recommend a Planet Money episode from 2017 that first got me thinking about this topic. In the intro, there is a memorable interview with an Australian couple who don’t even know when their tax day is. As an American, it’s unfathomable that someone wouldn’t know that April 15th is tax day.

But this is the reality in pretty much every other advanced country (at least 36, to be more precise), where they have a system where the central tax agency prepares tax filings for taxpayers.

In general it seems rather obvious that the US has a suboptimal system that lags behind the rest of the world. The problem is clear and the solution is straightforward.

This is the power of a flywheel when used for evil—just as a flywheel can create totally new, amazing companies and systems and establish them as leaders for decades, it can also be used to establish and cement nefarious advantages as well.

Devil’s Advocate

I make a best faith effort not to look at things as black and white. In this case, while it feels pretty obvious to me that the situation is suboptimal and that there are bad actors involved, I wanted to understand if there were any good arguments against something like return-free filing, the consensus common sense alternative to our existing mess of a system.

I found three common arguments:

1: Conflict of Interest

If the entity which is enforcing your taxes is also the one calculating them, isn’t that a conflict of interest? As an Intuit spokesman has said: “we empower our customers to take control of their financial lives, which includes being in charge of their own tax preparation,” he said, adding that a “government-run pre-filled tax preparation system that makes the tax collector (who is also the investigator, auditor and enforcer) the tax preparer is fraught with conflicts of interest.”

There are a lot of problems with this argument, but I’ll list four:

The IRS already is calculating everyone’s taxes—in fact, that’s how they decide if you did it correctly or not.

Many other countries already do exactly this and there aren’t any real complaints.

Having for-profit companies dictate our tax policy seems to be a much more obvious conflict of interest.

It can be opt out: nobody would require anyone to use a return free system.

2: Sneaky Tax Increase

As discussed in Planet Money, tax policy influencer Grover Norquist (he of the famous pledge that has somehow ensnared hundreds of our politicians for years) has tended to side with industry, under the argument that if there is a return-free system, the IRS will manage to sneak in some additional taxes. Furthermore, it will disadvantage our poorest and least educated citizens who will be least likely to fight back.

This argument might hold some water, but the fact of the matter is that Intuit already levying a de facto tax on the American public; I’d rather roll the dice that the American government would tax us according to its own laws, rather than whatever law a clearly conflicted for-profit company is advocating for.

3: A ‘teachable’ moment

This one really got me. Intuit and politicians it has lobbied have made the case that it’s important for tax day to be a burdensome event so that we can all have a ‘financial checkup’ once a year. Intuit’s own ‘tax & financial center’ put it well:

Preparing our taxes is our own financial checkup and a way to become more informed and empowered to take positive actions to ensure financial wellness. It’s a time to ask the tough questions that can make or break our budget or change the course of our lives. Are there job training or educational opportunities that can help grow my career and income? Am I contributing all I can and should for retirement? Should I open an education savings account for my children?

Funny, I must have missed those questions while I was filling out my taxes last year.

These arguments are all at-best very weak. It seems clear to me that the only actual argument isn’t being stated explicitly: that if the US were to adopt a return-free system, Intuit would go out of business.

Future Outlook

There’s been a lot happening in this space over the past couple of years. A new bill—the Taxpayer First Act—was passed in 2019, and Intuit was lobbying hard to ensure it included a clause that would cement the Free File Agreement (which today is just a memorandum of understanding) into permanent law:

“Political donations and lobbying surely have something to do with this, as Intuit and H&R Block spent a combined $6.6 million last year on lobbying. But apparently it wasn’t enough — not for now anyway.”

The clause got killed, and the drama rolls on.

More recently, the FTC opened an investigation into Intuit’s practices. The IRS appears to have been too conflicted, inept, or otherwise unable to reign in Intuit’s influence, but maybe the FTC can show up.

Intuit, for its part, isn’t pleased with how much work the government is asking it to do:

The new FTC request “is incredibly burdensome” with “broad document demands,” wrote Intuit’s lawyers, from the firm WilmerHale. “And notwithstanding the new and unanticipated stresses of work in the COVID-19 environment, the staff seeks investigational hearings with at least eight different Intuit employees, and the CID includes a sixteen-topic corporate hearing notice that will require at least five Intuit employees to testify over several days.”

Hm..sounds like a lot of paperwork. Better get started early this year!

That’s it for today’s edition of The Flywheel. Thanks a ton to Tanya for helping out with this one. Let me know what you thought of this piece by clicking one of the links below👇🏼.

Loved it • Liked it • Neutral • Not your best • Hated it

If you liked this article, smash that like button and share with a friend! Let me know your take on Twitter here.