Twilio and the Magic of Undifferentiated Heavy Lifting

Why Twilio is one of the most interesting companies you’ve never heard of

Welcome to the new subscribers! If you’re reading this but haven’t subscribed, click below to join 2,588 of your smartest friends and peers who receive The Flywheel in their inbox every other Tuesday.

🎧 In case you missed it last time, I launched a podcast! In fact, you can listen to my sweet, sultry voice reading this article if you prefer listening over reading.

In the coming months I’ll be adding interviews with Packy McCormick, Jason Jacobs, Courtland Allen, and many more in addition to audio versions of my essays. Subscribe on Spotify, Apple, Google, Stitcher or pretty much anywhere else—if it’s missing from somewhere you use, let me know!

Onto the article.

[Disclosure: I started buying Twilio stock last year as I learned more about the company in preparation for this piece. I now hold a modest position in the company]

Undifferentiated, Heavy Lifting

Imagine you’re the parent of an extremely active toddler, like my 2-year-old nephew Abe. Between your job and the ‘times’ (play, bath, nap, bed), you also need to find time to keep your family well-fed and the house in working order. You could spend 2 hours a week at the grocery store, and another two cleaning every corner of the house. But that time has to come from somewhere, and—SHOCKER—your kid doesn’t care where the groceries come from.

Alternatively—assuming you can afford it—you can schedule recurring grocery deliveries from any number of sources and even hire a cleaning person to tidy up your house. Voila! In 5 minutes you just saved 4 hours. This is a real-life example of undifferentiated heavy lifting (UHL), a term that describes a certain type of business.

I first encountered this concept while working at Amazon, and its origins go back at least as far as the creation of AWS in 2006. With AWS, Amazon builds software where “each area is a career unto itself, doing poorly in an area will cause the entrepreneur to fail, and yet doing a competent job at each one is simply the price of admission”. In other words, the lifting is very heavy, but it doesn’t contribute to one’s differentiation.

Millions of parents opt for grocery delivery and cleaning services because what your kids really care about is the facetime they get with you, exhausted though you may be. But the UHL analogy to parenthood doesn’t map perfectly from the way it’s applied in the business world because it doesn’t incorporate fixed costs.

Parents are actually just trading one variable cost for another, typically higher one. If they want to do their grocery shop in person one time, they easily can.

Companies who provide UHL—or at least the extremely successful ones like AWS—are valuable precisely because of the fixed costs associated with their service. Amazon invests many billions of dollars developing the infrastructure to sell to its AWS customers. If a customer decided—just this once—to buy and set up its own servers, it would be so much more expensive and less convenient than doing it through AWS, that the example itself doesn’t even make sense.

The Heavy Lifters

There’s a class of company that provides UHL that pretty much every company in the world needs. In a sense these companies are the fundamental utilities of the internet.

Every company needs the ability to store, query, and access data (including their apps/sites and customer data), but increasingly few are willing to manage the infrastructure that it requires (not to mention the inefficiencies of paying for stuff even when you’re not using it) the way AWS does.

Every company needs to receive payments, and many need to disburse them—few are able to invest in establishing relationships and ensuring compliance with regulatory authorities and banks all over the world the way Stripe has.

Every company needs to communicate with customers over phone, text and email, but few are able to integrate with every telecom company in the world to make sure a phone call works anywhere a customer might live, the way Twilio has.

And even if they were able to, they shouldn’t, because their customers don’t really care.

These fixed-cost based UHL providers are especially valuable not only because they do the things others don’t want to, but also because they become increasingly hard to compete with over time. As they grow, they have a series of connected flywheels that increase the amount of lifting they can do for customers over time.

These companies charge a small fee every time their service is used; turns out even a tiny fee adds up when a service is used trillions of times. AWS went from zero to $40B in revenue in ~15 years, and Stripe (which is still private) is rumored to be raising at a $100B valuation. But even at huge revenue amounts, profitability can be a challenge for UHL providers because of their unique mix of fixed and variable costs.

Today’s piece is all about the one that gets the least airtime, at least of these three—my personal favorite—Twilio. We’ll explore Twilio’s background, its flywheel, and its long path to profitability.

What is Twilio (hint: you already use it)

Twilio provides undifferentiated heavy lifting (UHL) around customer communication. Its roots are in telephony: Twilio’s early products allowed its customers—software developers at other companies— to place phone calls and send text messages with a simple API call.

Twilio is possibly the company that people interact with the most without knowing they exist (apparently this was true even in 2014). In fact I can almost guarantee that each of you has used Twilio many times, even if you don’t realize it. When you receive a text to authenticate your account on basically any app, that’s probably Twilio. When Doordash texts you saying your order is downstairs? Twilio.

Twilio was started by Jeff Lawson, who was an early Product Manager at AWS and a multiple-time startup founder before that. He realized that nearly every company—including his own—struggles to figure out how to call customers in a reliable way, and that there may be an opportunity to provide a different flavor of UHL than what AWS was setting out to.

Twilio took off almost immediately, and it’s not hard to understand why. Before, if a company wanted to call or text its customers, they’d have to either hire humans to do it manually, or spend several years and many millions of dollars to set up the infrastructure to do so programmatically. With Twilio, any developer at any company can fire off a text for about 3/4 of a penny by adding code like the following into its workflow:

client.messages

.create({

body: 'This is the ship that made the Kessel Run in fourteen parsecs?',

from: '+15017122661',

to: '+15558675310'

})Twilio is part of a much broader trend towards application programming interfaces (APIs) that I won’t go too deep into in this piece, though suffice it to say that I’m big on the API train. In just a few lines of code, any developer in the world can execute previously unthinkably complex operations, accessing the collective development work of Amazon, Stripe, Twilio, and many, many others. Twilio’s own CEO, Jeff Lawson, recently published a book that goes into more detail on the history of the API economy that I loved!

As Lawson writes in Ask Your Developer, “Writing software that could interact with the telecom system turned out to be an insanely difficult challenge”, and it proved to be a challenge a ton of companies were willing to pay to avoid.

As the world has shifted towards heavier and heavier mobile use, demand for Twilio’s products has only increased. Today Twilio boasts a market cap of nearly $60B (or 1.2 Pelotons) and has been growing its revenue YoY between 40% and 80% every quarter since it went public in 2016. Annual revenue topped $1B for the first time in 2019:

Twilio is growing both by acquiring new customers and by growing the amount existing customers spend. Customer net dollar retention—meaning the total spend by a specific customer compared YoY— has been above 130% almost every quarter since going public.

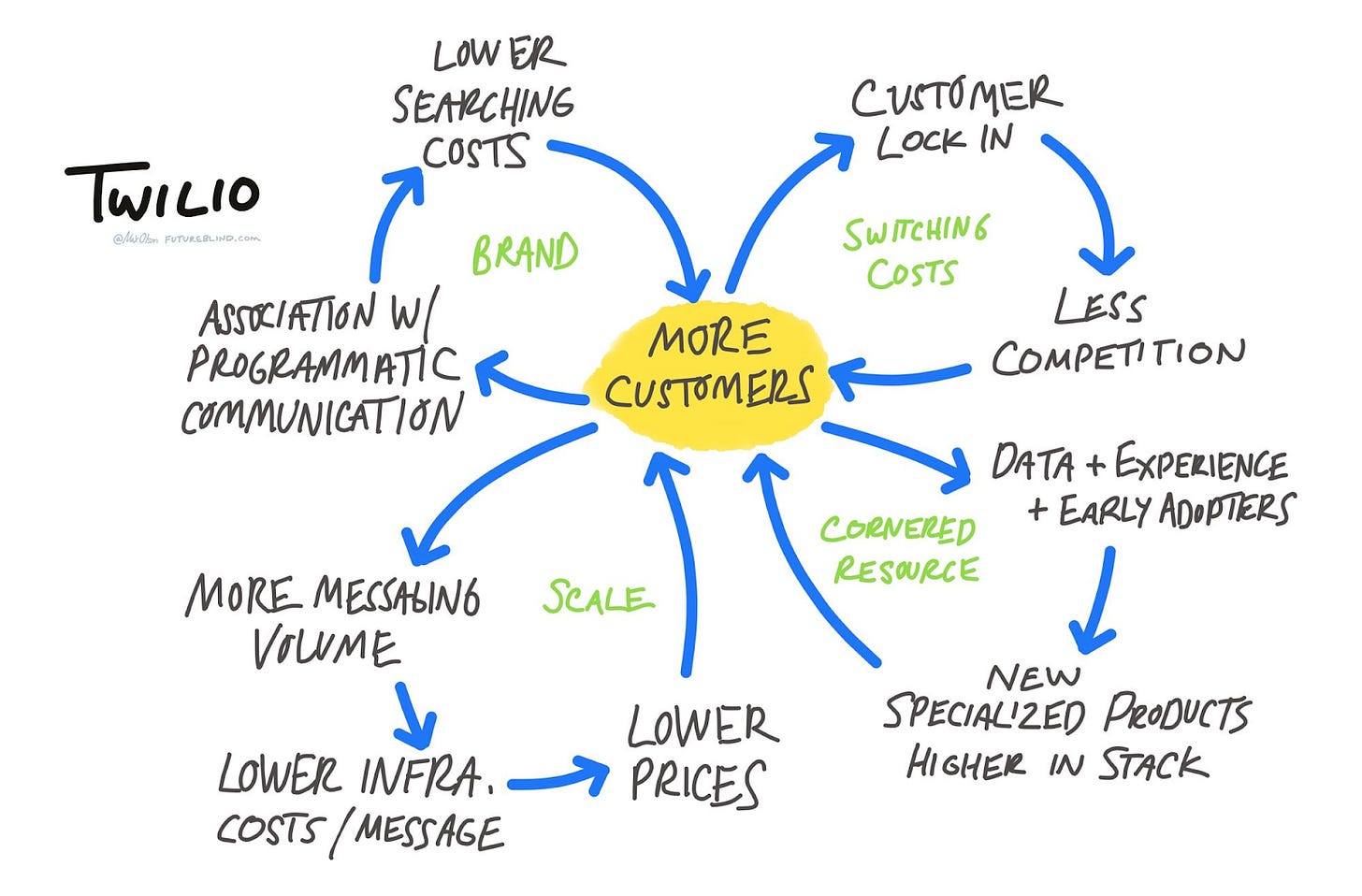

Twilio has several complementary flywheels that lead to more customers and—even more crucially given the business model—more usage from existing customers.

The Flywheel

I collaborated with Max Olson, Head of Product at Mashgin and author of Future Blind, on the Twilio flywheel—hence the beautiful drawing! Max has done a lot of thinking in public about flywheels in general and I’m excited to work with him on this and future pieces. He recently wrote a great piece exploring the idea of Tech Stacks in general that touches on Twilio as well that you should all check out.

Brand

Although enterprise software companies are not typically known for their brands, Twilio is one of the exceptions. The more it's used, the harder it is for developers to think of anything else for this need.

From a 2018 Twilio investment thesis from Heller House: “It is hard to overstate the energy and developer enthusiasm at Twilio’s developer conference this year; there is no other company doing anything close to what Twilio is doing in communications APIs. As Twilio grows and innovates into higher level APIs, and as its Super Network becomes more reliable and cost-effective, it’s possible that Twilio reaches a tipping point and captures so much developer mindshare and brand awareness, it gets to the point where “you can’t get fired for using Twilio.””

Switching Costs

Once Twilio is integrated into a codebase, it's costly (in terms of money, time, and trust) to switch to another provider. And we’ve already discussed how costly it would be for a company to build its own solution from scratch.

There’s a famous story about Twilio and Uber. Back in 2017, Uber was starting to get serious about becoming a public company, and it realized it was spending around $60 million per year on Twilio. With its new CFO, Uber decided to reduce its spend on Twilio and build its own communication stack in-house. When this was announced, Twilio’s stock took a beating temporarily but since then has taken steps to be less reliant on its biggest customers.

Uber is the exception that proves the rule: if a customer needs to get to $60m in spend before they even consider switching away from you (and I’d love to hear if Uber would want a redo on that decision!), then you’re probably going to be retaining pretty much all of your customers.

Economies of Scale

Twilio delivers such a massive quantity of text messages and other communications that its scale gives it enormous bargaining power. It can also spread its fixed infrastructure costs over more volume, leading to cheaper prices and potentially higher gross margins. We’ll dive into Twilio’s margin in the following section, but it’s interesting to note that Twilio appears to be using its scale economies to pass low prices on to customers. Fitting, given CEO Jeff Lawson’s Amazon roots.

Cornered Resource

With so many customers using Twilio's core API, they have a unique insight into what it's being used for — in the form of data, product experience, and access to early adopters. This learning then leads to the creation (or purchase) of new products focused on these use cases higher up in the stack. We’ll see some examples of this later.

A very Gross Margin

People are fairly bullish in general on Twilio, and the move in its stock price over the past ~12 months reflects that bullishness.

But one major knock against the company (maybe the only one) is profitability. Twilio is not now and never has been particularly close to turning a profit.

To put Twilio’s gross margin into context, take a look at gross margin compared to some other well-known SaaS companies:

The Telecom Tax

Twilio’s gross margin is in the low-ish 50s, lower than these other companies, in most cases by quite a bit. And it makes sense: while these other companies are more-or-less pure software companies, Twilio has some “hard” costs to contend with. After all, when a text or phone call gets placed, there’s an actual, physical telephone line involved, and an entire telecom industry that maintains it.

Twilio doesn’t break out what portion of its cost-of-revenue goes to telecoms, but it gives us a hint. In its most recent quarter, the 10-Q states: “In the three months ended September 30, 2020, cost of revenue increased by $80.2 million, or 59%, compared to the same period last year. The increase in cost of revenue was primarily attributable to a $67.9 million increase in network service providers’ costs and a $8.9 million increase in cloud infrastructure fees, both to support the growth in usage of our products.”

In other words, cost-of-revenue went up by $80M, and $76M of that went to the telecoms and AWS.

So Twilio keeps a smaller portion of its revenue compared to ‘pure software’ peers, and it also isn’t shy about pouring everything it keeps net of fees (and then some) on new product development. When Twilio filed to go public in 2016, Ben Thompson summarized Twilio’s financial picture as follows:

“Twilio isn’t quite a typical SaaS company: while the costs of revenue for a SaaS company are typically fixed, and thus benefit from leverage as the customer base grows, Twilio’s costs are mostly variable thanks to the payments it must make to telecom providers that actually implement Twilio’s services. To that end Twilio’s cost of revenue increased 80% last year, and 60% the year before; the company is gaining some leverage, but not much, and never will. Meanwhile, R&D — the other place to gain leverage — grew by 95% last year, which was even more than revenue.” In other words, Twilio doesn’t spend less per dollar earned over time, and it only increases the extent to which it invests in new products.

The story has more or less stayed the same over the past 4 years.

Path to Profitability

What might lead Twilio to profitability? In any given short term period, Twilio could mess around with pricing: for example, they could slightly increase prices (or not pass on savings to customers), or invest less in R&D. But given everything we know about Twilio’s history, that seems unlikely.

The long-term answer is much more likely to be about expanding margin by adding product offerings beyond the core Twilio products—read, those that require relatively large payments to telecom providers—towards more ‘pure software’ ones. Twilio is already doing this in two categories:

Margin Expansion by Acquisition

In 2019, Twilio acquired SendGrid, a leading, API-based email provider. There have rarely been more obvious acquisitions than this one. Twilio’s mission is to make it easy for its customers to communicate with its own end-customers. Adding the ability for them to do so via email is a no-brainer. Maybe as important, email is less expensive than phone-based services. SendGrid gross margin was in the mid-to-high 70s shortly before the acquisition.

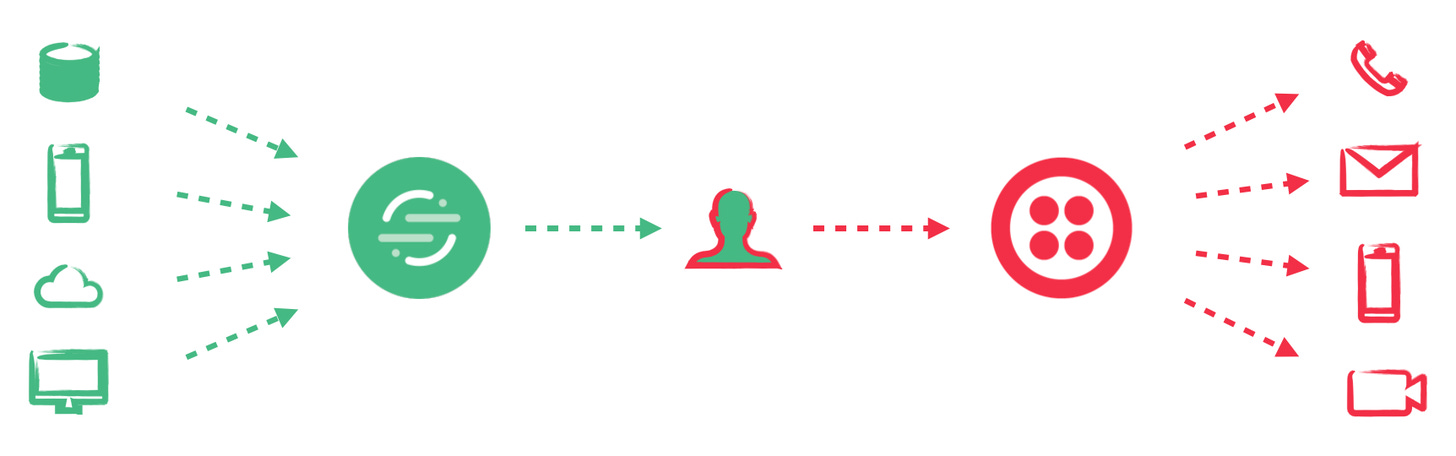

In 2020, Twilio made a more ambitious acquisition, this time of Segment, a customer data platform. Segment allows companies to better understand its customer data by stitching together inputs and outputs in a series of clever ways (I’d be irresponsible if I didn’t link out to Justin Gage’s primer on Segment—it’s an excellent piece, if you’d like to dive deeper). Companies today collect data from many sources, and send them to many destinations. Segment helps them standardize the data and combine it in a way that facilitates a more holistic understanding of customer behavior.

Twilio’s products (pre-Segment) have all been about outbound communication from companies to their customers. If a company wants to send a text or an email, there’s really no better way than to use Twilio. But the logic that determines when or why to send that text? Totally up to the company. Twilio waits to be put to work, and then executes its task faithfully.

Segment adds what Rob Litterst of Good Better Best calls the Yin to Twilio’s Yang:

"Put simply, the acquisition of Segment opens up a bigger-picture strategy for Twilio, allowing them to offer customers the dream of a holistic platform that can help them both understand and engage with their customers."

With Segment, Twilio can now offer its customers the ability not just to faithfully execute tasks, but to inform them.

Acquisitions like SendGrid and Segment aren’t only about margin expansion, but you can bet that they were part of the calculus. Others are surely coming: Ben Thompson and others have speculated that an advertising acquisition would be a logical next step, as it would allow Twilio customers to traverse the entire customer journey (acquisition -> conversion -> understanding -> engagement) using only Twilio products, and any synergies the company could cook up accordingly.

Margin Expansion by Innovation

In addition to M&A, Twilio also has an incredible opportunity to package up the behaviors it observes from customers into new products. The best example of this so far is Twilio Flex: a product for call centers. In just a few lines of code, any company can spin up a call center.

From Twilio’s Master Plan, again: “Twilio noticed that many customers were using its lower-level building blocks to build call centers. Why not do more of the heavy lifting on their behalf? This year, Twilio launched Flex, its call center API.”

It’s interesting to note that customers were already using Twilio to build virtual call centers. Twilio decided that they could enable a better customer experience if they offered the service directly.

Twilio has also been launching an increasing number of ‘Solutions’, which are combinations of their existing APIs that represent common use cases. From Twilio’s 2019 10-K: “as we observe what use cases are most common, and the workflows our customers find most challenging, we create Solutions to bring these learnings to a broader audience. While developers can build a broad range of applications on our platform, certain use cases are more common.”

There’s some well-known product advice that goes something like “watch what unexpected behaviors users perform with your product—it often will surprise you”; Twilio is a great example of this in practice.

Closing Thoughts

I asked Twitter for the best bear case for Twilio. I didn’t get a ton of responses, and I’m going to choose to interpret that as ‘there aren’t a lot of bear cases for Twilio’. The responses I did get seemed to echo that sentiment:

The truth is that in my view, Twilio is in a rare category of company: they provide a product that almost every company in the world needs, and are on a path to realizing wider margins over time. On top of that, the stuff they do is just plain hard, and generally not worth it to developers to figure out on their own. And—though I haven’t talked much about competition in this piece—Twilio’s first-mover head start actually is a real advantage in this case as the flywheel demonstrates, in particular with the significant fixed costs involved with getting started in this space.

Like its utility brethren, Twilio is on the path to being part of the no-brainer stack on top of which to build a company. While the financial profile of such a company might look different than others in the short term, the long-term vision is the key here. And even though Twilio has become a hot stock recently, analyzing its short term financial results in the context of that vision misses the forest for the trees.

That’s it for today’s edition of The Flywheel. Thanks a ton to Tanya, Max, and Mom for helping out with this one. Let me know what you thought of this piece by clicking one of the links below👇🏼.

Loved it • Liked it • Neutral • Not your best • Hated it

If you liked this article, smash that like button and share with a friend! Let me know your take on Twitter here.